Viewing marketing as a revenue driver instead of a cost center fundamentally changes how companies allocate resources and measure success. Companies using HubSpot’s marketing platform achieve an ROI of $5.10 per dollar spent, yet many finance teams still treat marketing budgets as discretionary expenses to cut during tight quarters. This outdated perspective limits growth potential, while competitors who embrace marketing as a revenue generator pull ahead.

The cost center mentality creates a vicious cycle. Marketing gets underfunded, delivers weak results from inadequate resources, gets labeled ineffective, and faces further budget cuts. Meanwhile, companies treating marketing as a revenue driver invest strategically, measure business outcomes, optimize for ROI, and scale what works.

In this guide, we’ll build the strategic case for marketing as a revenue driver that resonates with finance-minded executives. Whether managing internal teams or partnering with growth marketing agencies, shifting this fundamental perspective unlocks sustainable growth.

The Cost Center Versus Revenue Driver Mindset

How organizations view marketing determines resource allocation and strategic priority.

Cost Center Characteristics

Companies viewing marketing as a cost center exhibit predictable patterns.

Cost Center Thinking:

- The marketing budget is cut first during downturns.

- Success is measured by activity metrics, not outcomes.

- Marketing is excluded from strategic planning.

- Focus on minimizing spend rather than maximizing return.

- Underinvestment relative to growth opportunities

This approach treats marketing like facilities or legal—necessary overhead to minimize.

Revenue Driver Characteristics

Organizations viewing marketing as a revenue driver operate fundamentally differently.

They evaluate marketing by revenue contribution and customer acquisition efficiency, involve marketing in strategic planning and resource allocation, scale investment with growth, and prioritize ROI optimization over cost-cutting.

This mindset treats marketing like sales—a growth function deserving strategic investment.

Why The Shift Matters Now

Market conditions increasingly favor companies embracing marketing as a revenue driver.

Digital Transformation Changes The Game

Marketing accounts for 57.1% of marketing budgets, enabling unprecedented measurement and optimization. Digital channels provide clear attribution from marketing activity to revenue outcomes.

This visibility makes the revenue driver case easier to prove than ever before. Every dollar spent and every customer acquired can be tracked and measured.

Customer Acquisition Economics

Understanding unit economics reveals marketing’s true revenue impact.

Calculate customer lifetime value, acquisition cost per channel, payback period, and contribution margin. These metrics demonstrate whether marketing generates positive returns or wastes resources.

Cost center thinking ignores these economics. Revenue driver thinking optimizes them relentlessly.

Building The Financial Case For Marketing As A Revenue Driver

Finance executives respond to numbers, not marketing theory. Build your case with financial metrics.

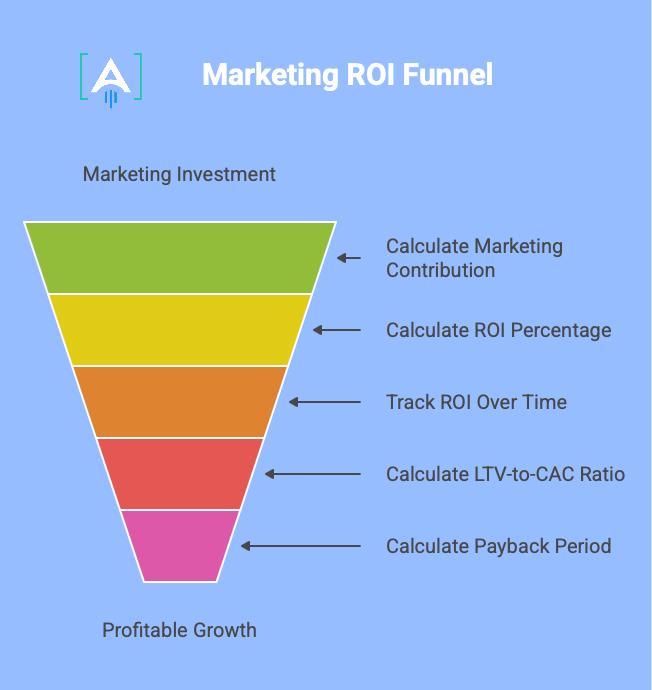

The ROI Framework

Start with simple return-on-investment calculations that CFOs understand.

Basic ROI Calculation: Revenue attributed to marketing minus total marketing investment equals marketing contribution. Divide the marketing contribution by the marketing investment to calculate the ROI percentage.

Track this monthly and quarterly. Positive ROI demonstrates marketing as a revenue driver. Improving ROI over time demonstrates the effectiveness of optimization.

Customer Lifetime Value Versus Acquisition Cost

The LTV-to-CAC ratio indicates whether marketing drives profitable growth.

Healthy businesses maintain LTV-to-CAC ratios of 3:1 or higher. This means customers generate three times their acquisition cost in lifetime value. Lower ratios indicate unprofitable customer acquisition. Higher ratios suggest underinvestment in growth.

Calculate this ratio by channel to identify where marketing drives the best returns.

Payback Period Analysis

Finance teams care deeply about cash flow and capital efficiency.

Calculate how many months the marketing investment takes to pay back through customer revenue. Shorter payback periods mean faster capital recovery and higher efficiency.

Target payback periods under 12 months for subscription businesses. Longer periods strain cash flow and slow growth.

Measuring Marketing As A Revenue Driver

Shifting mindset requires changing marketing measurement systems.

The Right Metrics Matter

Replace activity metrics with outcome metrics that connect to revenue.

Revenue Driver Metrics:

- Marketing-sourced revenue percentage

- Customer acquisition cost by channel

- Marketing contribution to the pipeline

- Win rates for marketing-sourced deals.

- Revenue per marketing dollar invested

These metrics tie marketing directly to business outcomes that finance teams value.

Attribution Models That Work

Accurate attribution demonstrates marketing’s revenue contribution.

First-touch attribution shows which channels drive customer relationships. Last touch attribution reveals what closes deals. Multi-touch attribution distributes credit across the customer journey.

Each model provides different insights. Use multiple views to build a complete understanding of marketing’s revenue impact.

Common Objections From Finance

Anticipate and address typical CFO concerns about marketing investment.

“Marketing Can’t Prove ROI”

This objection reflects poor measurement, not inherent marketing limitations.

Modern marketing technology enables comprehensive tracking from initial touch to closed revenue. The issue is typically a lack of proper systems and processes, not a fundamental inability to measure.

Invest in attribution systems and commit to measurement discipline. Prove ROI conclusively through data.

“We Can Cut Marketing And Still Hit Numbers”

Short-term thinking that sacrifices long-term growth.

Marketing builds a pipeline that converts over months. Cutting marketing today impacts revenue six to 12 months later. By the time revenue declines appear, rebuilding the pipeline takes even longer.

Model the lag effects of cuts to marketing investment. Show finance how today’s cuts create tomorrow’s revenue shortfalls.

“Sales Drives Revenue, Not Marketing”

False dichotomy that ignores how modern buying works.

Marketing shapes perception, generates awareness, builds consideration, and qualifies prospects before sales engagement.

Sales closes deals. Marketing creates the opportunities for sales to close. Both drive revenue in integrated systems.

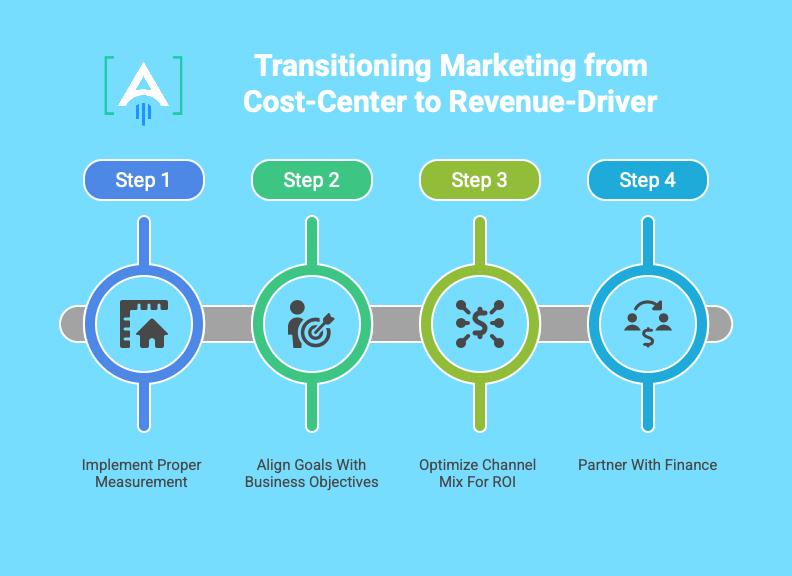

Making The Transition

Moving from cost-center to revenue-driver thinking requires systematic change.

Step 1: Implement Proper Measurement

You can’t manage what you don’t measure. Build measurement infrastructure first.

Set up attribution tracking across channels. Implement CRM integration to connect marketing to revenue. Create dashboards showing revenue impact, not activity metrics. Establish regular reporting cadence with finance.

Step 2: Align Goals With Business Objectives

Marketing goals must directly support business goals.

If the business targets 30% revenue growth, marketing should own a specific contribution to that target. Translate business objectives into marketing metrics, including pipeline generation, customer acquisition, and revenue by segment.

This alignment makes marketing’s role as a revenue driver explicit and measurable.

Step 3: Optimize Channel Mix For ROI

Demonstrate revenue driver mentality through ruthless optimization.

Reallocate the budget from underperforming to high-ROI channels on a quarterly basis. Kill tactics that don’t generate positive returns. Double down on proven revenue generators. Show finance that marketing manages resources for maximum return.

Step 4: Partner With Finance

Build collaborative relationships rather than adversarial dynamics.

Include finance in marketing planning. Share data openly and honestly. Ask for feedback on measurement approaches. Demonstrate fiscal responsibility and ROI focus. Speak in financial terms that finance understands.

The Growth Impact Of Marketing As A Revenue Driver

Companies making this shift see measurable acceleration.

Increased Marketing Investment

Viewing marketing as revenue generation justifies larger budgets. When marketing proves positive ROI, finance approves budget increases because they generate returns.

This creates a virtuous cycle: more investment fuels more revenue, which justifies further investment.

Better Cross-Functional Alignment

Marketing as a revenue driver integrates with sales, product, and customer success.

Integration Benefits:

- Sales and marketing align on pipeline targets.

- The product incorporates market insights.

- Customer success leverages marketing content.

- All functions optimize for customer lifetime value.

This alignment amplifies overall business effectiveness.

Strategic Priority And Resources

Revenue-driving functions get prioritized during planning and resource allocation.

Marketing earns a seat at the strategic table. Budget requests get serious consideration. Hiring needs receive appropriate attention. Technology investments get approved.

Conclusion: The Strategic Imperative

Marketing as a revenue driver represents a strategic necessity, not a philosophical preference. With digital transformation enabling unprecedented measurement, the case for marketing as a revenue generator grows stronger by the day.

Finance-minded executives respond to clear metrics showing revenue contribution, customer lifetime value-to-acquisition cost ratios, payback periods, and marketing ROI. Replace activity metrics with outcome metrics. Implement proper attribution. Optimize ruthlessly for returns.

Many companies accelerate this transition by partnering with growth marketing agencies that operate from a revenue driver perspective from day one. Agencies focused on business outcomes bring measurement discipline, proven frameworks, and results orientation that align with finance team priorities.

At Azarian Growth Agency, we help businesses transform marketing from a cost center to a revenue driver through integrated strategies combining measurement rigor with execution excellence. Our comprehensive approach spans content marketing, sustainable organic growth, AI marketing, optimized targeting at scale, data analytics, rigorous attribution to prove ROI, and strategic planning to align marketing investments with revenue objectives.

Ready to shift from cost-center to revenue-driver thinking?

Work with our growth experts who measure everything, optimize relentlessly, and speak the language of ROI that finance teams respect.