Marketing budget trends 2026 signal the largest channel reallocation since mobile advertising emerged. Business owners and CEOs face a decisive moment: adapt spending toward AI platforms or watch customer acquisition costs spike as prospects migrate to where traditional budgets don’t reach.

The data tells a compelling story. Organizations allocate 10-15% of marketing budgets to AI, with 88% of marketers using AI daily and 85% planning significant increases by 2026. Additionally, 60% of searches end without clicks, with users satisfied by AI-generated answers, fundamentally changing where brands must invest to capture attention.

In this guide, we’ll reveal how budgets will reallocate from traditional search to AI platforms, analyze ChatGPT ads market potential, and provide frameworks for strategic budget reallocation before competitors capture market share.

Understanding Marketing Budget Trends 2026

Marketing budget trends 2026 reflect fundamental shifts in customer behavior and platform economics. The same $1,000 monthly spend delivering strong results five years ago now buys significantly less reach and conversion volume as competition intensifies.

AI marketing agency expertise becomes essential for navigating this transition. Brands attempting solo budget reallocation often waste quarters testing approaches that agencies already validated.

The Traditional Search Decline

Google search maintains dominance but faces systematic erosion. Zero-click searches now capture 60% of queries, meaning paid search impressions deliver decreasing value as users find answers without clicking ads.

Consequently, cost per acquisition rises while conversion rates stagnate. The same budget that generated 100 customers last year now delivers 70, creating compound effects on growth targets and profitability.

Single-channel strategies no longer compete. User attention splits across streaming platforms, retail media networks, creator content, chat-based search, and AI recommendation engines. Marketers must follow how people actually make decisions today.

Why AI Platforms Will Capture $50B

The $50B shift represents a conservative projection based on current adoption curves and monetization timelines. ChatGPT, Perplexity, and similar platforms serve billions of monthly users through advertising-free models today, but are building monetization infrastructure.

Moreover, OpenAI projects $1 billion from “free user monetization” in 2026, growing to nearly $25 billion by 2029. This represents paid advertising at an unprecedented scale.

Early budget allocation to AI platforms delivers advantages similar to early Google Ads adoption. Low competition and close attention create temporary windows where returns dramatically exceed mature channel performance.

AI Advertising Spend Projections

AI advertising spend will accelerate dramatically as platforms launch monetization products throughout 2026. The question isn’t whether shift happens but how quickly brands recognize opportunity.

Additionally, companies are building proprietary AI models trained on their data to create unique customer experiences. This advanced deployment requires a dedicated budget beyond basic tools.

Data analytics and reporting capabilities track AI spend ROI as platforms mature. Early measurement frameworks prove value before board-level budget decisions.

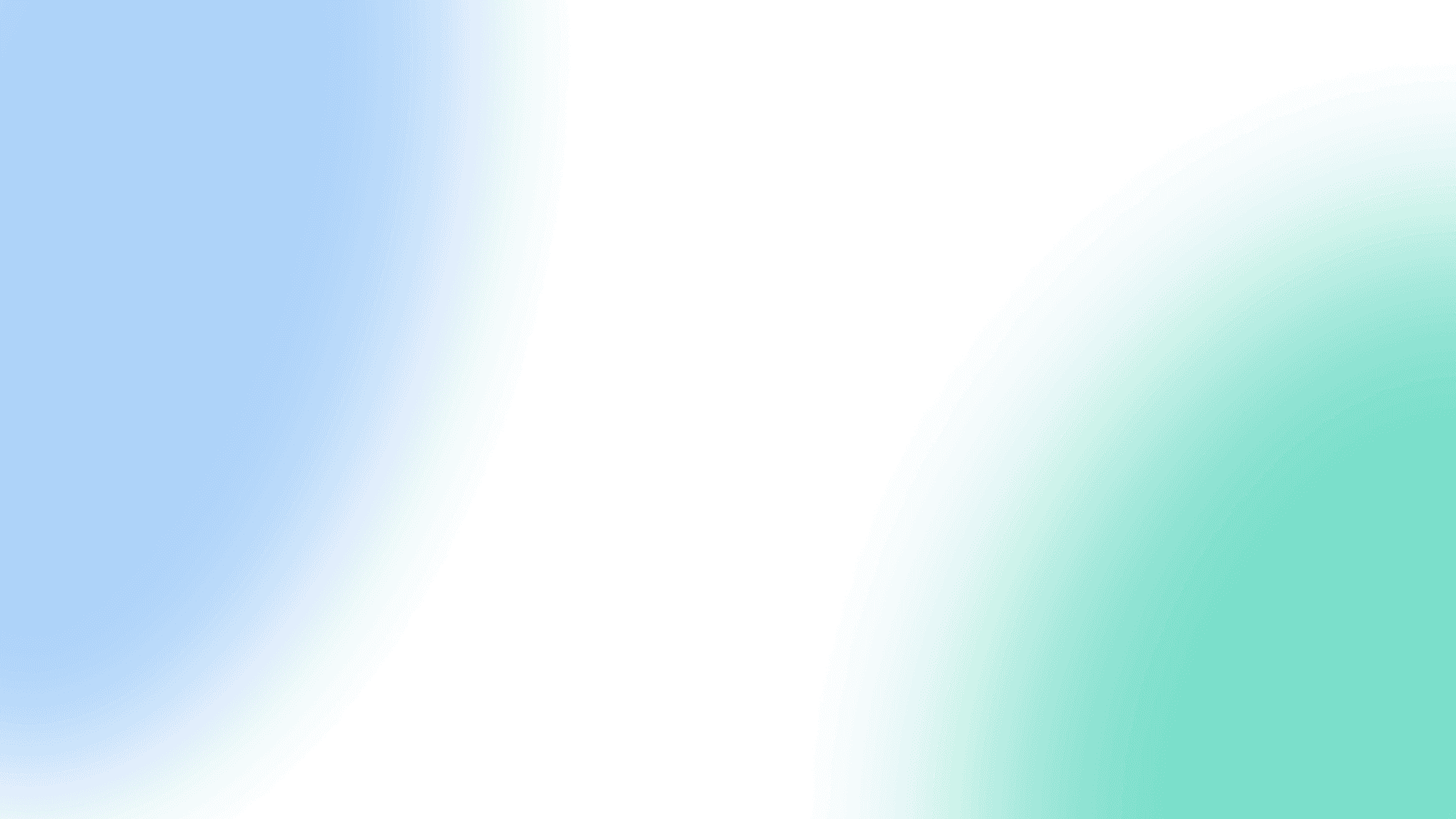

Current Spend Distribution

Traditional search still continues but experiences decline the effectiveness. Budget inertia keeps money flowing to familiar channels despite eroding returns.

Social advertising is expected to grow by 9.37% each year. Meta and LinkedIn provide consistent performance amid search volatility.

Emerging AI platforms currently receive 10-15% allocation as early adopters test capabilities. This share will triple by late 2026 as monetization products launch and performance data validates spend.

Furthermore, conversion rate optimization expertise ensures that dollars allocated to new channels convert effectively, justifying continued investment.

The 2027 Budget Mix

AI platforms will capture 25-30% of digital budgets by 2027 as ChatGPT ads, Perplexity Business, and similar products mature. This represents $50B+ reallocation from traditional channels.

Search maintains importance, but share decreases to 35-40% as zero-click behavior accelerates. Google remains table stakes but no longer dominates spending like the 2020-2023 period.

Social and retail media grow to 35-40% combined as commerce integration reduces friction. In-platform purchasing aligns with consumer behavior, preferring streamlined experiences.

The reallocation isn’t binary replacement. Successful 2027 budgets integrate all channels strategically rather than overweighting single platforms.

ChatGPT Ads Market Size Opportunity

ChatGPT ads market size represents an enormous untapped opportunity. 810 million weekly active users engage with the platform for research, planning, and decision-making, creating massive advertising potential.

Consequently, AI platforms now represent the second-largest qualified lead source at 34%, behind only social media at 46%. This high-intent traffic demands a budget allocation matching its contribution.

Content marketing strategies must prepare for AI platform advertising. Organic visibility complements paid placements, creating an integrated discovery presence.

Expected Monetization Models

Contextual recommendations within conversations present relevant products or services based on user queries. These native placements integrate naturally into chat flow without disrupting the experience.

Sponsored research results provide enhanced visibility when users conduct comparative analysis. Brands appearing in AI-generated comparisons gain consideration set inclusion.

Affiliate-based placements enable direct commerce within AI conversations. Users research and purchase without leaving the platform, reducing friction dramatically.

Moreover, AI content optimization ensures brand messaging performs in AI-native formats. Traditional ad copy fails when AI synthesizes information rather than displaying static creatives.

Early Adopter Economics

Launch timing estimates point to Q1-Q2 2026 for major AI platform advertising products. Early adopters benefit from low competition before market saturation drives prices up.

Initial CAC will run 40-60% below mature channel levels as platforms prioritize adoption over revenue maximization. This window typically lasts 6-12 months before competitive pressure increases.

Testing budgets of $5,000-10,000 monthly enable meaningful learning without excessive risk. This allocation proves the concept while maintaining traditional channel performance.

Additionally, AI marketing agency partnerships accelerate learning curves. Professional guidance prevents expensive mistakes during critical early adoption periods.

Search Advertising Future

Search advertising’s future involves sophisticated integration rather than complete displacement. Google remains dominant but shares an ecosystem with AI platforms, changing discovery dynamics.

Furthermore, autonomous AI manages campaigns end-to-end, generating creative, reallocating spend in real-time, and optimizing toward ROI with minimal human intervention. This automation enables portfolio management to be impossible manually.

Social media marketing complements search engine evolution. Multi-channel presence captures attention wherever prospects conduct research.

Google’s AI Integration

Performance Max campaigns demonstrate conversion increases. AI-powered automation delivers results that manual optimization can’t match.

AI Max for Search adapts campaigns to new search experiences, including AI Overviews and AI Mode. This flexibility ensures continued visibility as Google’s interface evolves.

Dynamic bidding adjusts spending hundreds of times daily based on conversion probability. Machine learning analyzes thousands of signals in real-time, optimizing performance continuously.

The winners maintain a Google presence while expanding to AI platforms. Omnichannel strategies capture demand regardless of where prospects conduct research.

Attribution Complexity

Privacy rules tighten, and user journeys spread across more platforms, making attribution increasingly murky. Even the best AI models cannot perfectly stitch journeys moving from TikTok to ChatGPT to websites.

Blended approaches win by combining platform-native attribution with incrementality testing. This dual measurement reveals true channel contribution versus platform-reported numbers.

Multi-touch attribution assigns credit across the entire customer journey rather than last-click oversimplification. AI interactions early in research receive appropriate credit alongside final conversion channels.

Moreover, data analytics and reporting platforms unify measurement across traditional and AI channels. Comprehensive dashboards guide budget allocation toward the highest-ROI investments.

AI Platform Advertising Strategies

AI platform advertising strategies differ fundamentally from search or social approaches. These channels prioritize trust-based recommendations over pay-to-play rankings, requiring content-first positioning.

Consequently, brands investing in thought leadership and authoritative content gain advantages over competitors relying purely on paid placements. AI platforms favor citing established sources regardless of advertising spend.

Content marketing becomes an advertising foundation. Organic visibility in AI responses creates credibility that enhances paid placement performance.

Building Pre-Launch Presence

Citation authority establishes a foundation before the launch of advertising products. Brands consistently mentioned in AI responses demonstrate credibility that supports eventual paid campaigns.

Original research generates proprietary insights AI platforms must reference directly. This unique content creates competitive moats competitors struggle to overcome.

Comprehensive guides earn repeated citations when users ask related questions. AI systems return to authoritative resources rather than seeking new sources for each query.

Additionally, AI content optimization ensures content speaks effectively to AI systems. This dual optimization maximizes visibility across organic and paid channels.

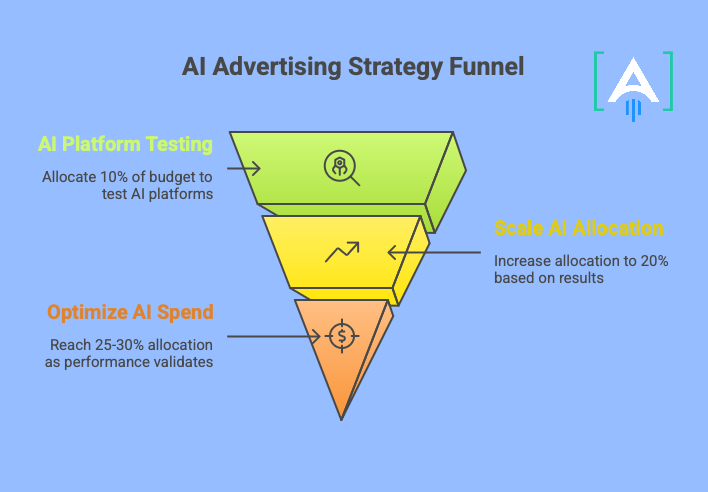

Budget Allocation Framework

One Phase (Q1 2026): Allocate 10% of total digital budget to AI platform testing. Maintain traditional channel performance while learning new platforms.

Second Phase (Q2-Q3 2026): Scale to 20% allocation based on initial results. Reduce lowest-performing traditional channels to fund AI platform expansion.

Three Phase (Q4 2026-2027): Reach 25-30% AI platform allocation as products mature and performance data validates spend. Maintain an integrated omnichannel presence.

Testing priorities:

- ChatGPT ads when available

- Perplexity Business placements

- AI-powered programmatic buys

- Contextual advertising in AI responses

Marketing Budget Allocation AI Era

Marketing budget allocation in the AI era requires flexibility over fixed annual commitments.

Furthermore, the shift from cost management to ROI-driven investment models unlocks growth. If campaigns consistently yield proven returns at target ROI, the budget becomes an investment portfolio rather than an expense.

Data analytics and reporting capabilities prove value to finance teams in real-time. This measurement enables dynamic allocation, impossible with annual fixed budgets.

Building Flexible Budget Systems

ROI thresholds determine spending rather than predetermined allocations. Channels delivering above-threshold returns receive increased investment automatically.

Weekly reviews enable rapid reallocation based on performance. Traditional quarterly adjustments move too slowly for a dynamic AI platform landscape.

Scenario planning prepares for various outcomes. Budget models account for faster or slower AI platform adoption than base projections assume.

Additionally, AI marketing agency partnerships provide strategic guidance in navigating budget flexibility. Professional expertise accelerates the transition from fixed to dynamic allocation models.

Financial Modeling

Customer acquisition cost trends guide reallocation decisions. Channels showing rising CAC lose budget to platforms delivering efficiency gains.

Lifetime value analysis ensures budget flows toward the highest-quality customers. AI platforms attracting prospects with strong LTV justify premium acquisition costs.

Payback periods reveal capital efficiency. Shorter payback from AI channels enables faster reinvestment, compounding growth advantages.

The math favors early AI platform allocation. Testing costs minimal amounts relative to missing permanent channel evolution.

Preparing for the Transition

Systematic preparation enables a smooth transition rather than reactive scrambling when AI advertising products launch. Early positioning captures advantages competitors miss.

Consequently, CFO budget planning teams should earmark upto 20% of Q4 marketing budget for pilot AI campaigns. This approach tests technologies in controlled environments and gathers ROI data justifying the 2026 investment.

Content marketing teams must prioritize AI-optimized formats now. Building citation authority takes months; waiting until advertising launches means competing without a foundation.

Organizational Readiness

Cross-functional alignment ensures marketing, finance, and operations support budget flexibility. Siloed decision-making prevents rapid reallocation opportunities demand.

Technology infrastructure enables tracking across traditional and AI channels. Unified measurement guides allocation rather than platform-biased reporting.

Team capabilities require upskilling in AI platform advertising. Professional development prepares teams for channel evolution rather than reacting after launch.

Moreover, AI marketing agency partnerships fill capability gaps during transition. Professional implementation accelerates results while internal teams develop expertise.

Conclusion

Marketing budget trends 2026 signal the $50B shift from traditional search to AI platforms by 2027, driven by 60% zero-click searches and 88% of marketers using AI daily. With organizations allocating 10-15% to AI currently and ChatGPT projecting $1B in 2026, growing to $25B by 2029, the reallocation timeline is compressed and decisive.

The framework spans understanding traditional search decline, projecting AI advertising spend growth to 25-30% of budgets by 2027, building citation authority before paid products launch, and implementing flexible budget systems enabling rapid reallocation as platforms mature.

Azarian Growth Agency combines over 20 years of growth marketing expertise with cutting-edge AI platform capabilities. We’ve helped clients secure over $4 billion in funding and generate more than $500 million in revenue through systematic strategies capturing channel evolution advantages.

Our AI marketing agency services implement budget reallocation frameworks, preparing brands for AI platform advertising launches. We build citation authority, testing infrastructure, and measurement systems, quantifying ROI as new channels mature.

Partner with us to navigate the $50B budget shift strategically. We combine financial modeling with platform expertise, helping you reallocate spend toward AI channels before competitors capture market share and drive costs up.